Unlocking Value: Transforming Commercial Properties into Lucrative Residential Spaces

Investing in commercial properties can be a highly profitable venture for several reasons. Here's a breakdown of why it might be a smart move.

Higher Income Potential

Commercial properties often yield higher returns compared to residential properties. This is because businesses are generally willing to pay more for prime locations that can attract customers and enhance their brand image.

Longer Lease Terms

Commercial leases tend to be longer, often ranging from 3 to 10 years or more. This provides a stable and predictable income stream, reducing the risk of frequent tenant turnover and vacancy periods.

Diverse Investment Opportunities

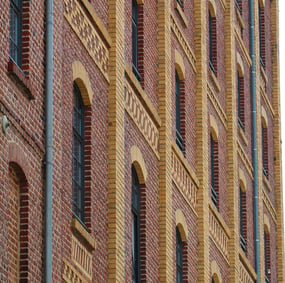

The commercial property market offers a wide range of investment options, including office buildings, retail spaces, industrial warehouses, and mixed-use developments. This diversity allows investors to tailor their portfolios to match their risk tolerance and investment goals.

Triple Net Leases

Many commercial properties operate under triple net leases, where the tenant is responsible for paying property taxes, insurance, and maintenance costs. This reduces the landlord's expenses and increases net income.

Appreciation and Value-Add Opportunities

Commercial properties can appreciate significantly over time, especially in high-demand areas. Investors can also increase property value through renovations, improved management, or by converting spaces to meet market demands, such as turning office spaces into residential apartments.

Tax Benefits

Investors in commercial real estate can take advantage of various tax benefits, including depreciation, mortgage interest deductions, and potential tax credits for energy-efficient upgrades.

Inflation Hedge

Commercial real estate is often considered a good hedge against inflation. As the cost of living rises, property values and rental income typically increase, preserving the purchasing power of your investment.

Professional Relationships

Commercial tenants are usually businesses, which can lead to more professional and stable landlord-tenant relationships. Businesses are often more invested in maintaining their leased space to ensure it aligns with their brand and operational needs.

Investing in commercial properties requires careful consideration and due diligence, but with the right strategy, it can be a lucrative addition to your investment portfolio.